Car Title Loan alternatives should be analyzed before committing to a car title loan. Title loans are expensive. The fact that they are high interest loans makes them suitable for short term solutions only.

There are plenty of online articles and blog posts about title loans being “bad”. It is important to note that many (not all) of these articles are published by title loan competitors or publishers compensated by title loan competitors.

Obviously it is in their best interest to provide “alternatives” that benefit them or the companies compensating them.

That would be fine if they actually provided some real, useful information for title loan customers. The problem, for most title loan customers, is that title loans serve as a necessary source of funds when no other sources exist.

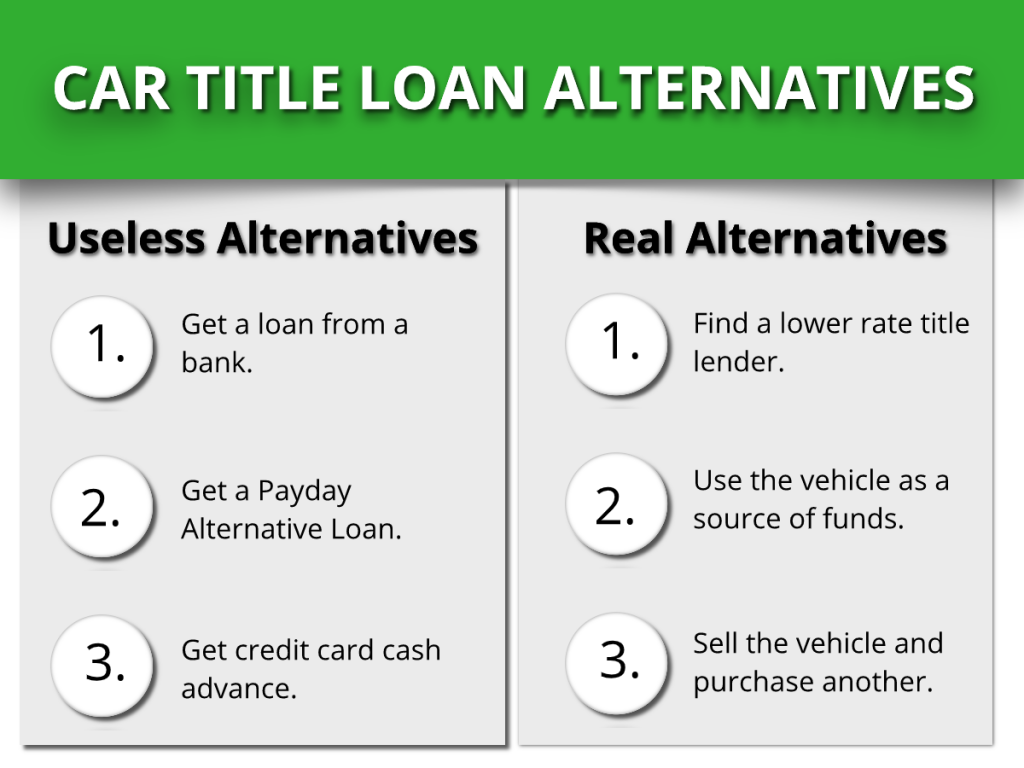

Most articles about “alternatives to title loans” do not include options that the typical title loan customer can capitalize on.

Two Problems with most “Title Loan Alternatives” posts

There are two problems with most of the posts about title loan alternatives. We mentioned the first, which is they are a way of advertising for title loan competitors.

The most common alternatives mentioned:

- Credit Card Cash Advance

- Payday Alternative Loan (PAL)

- Personal Loan

All three of these alternatives to a title loan benefit competitors to title lenders (banks and credit card companies).

However, since the interest rate is usually lower for all three of these you should definitely consider them before getting a title loan.

This brings us to the second problem: most of the alternatives provided are not viable for most title loan customers.

Why these Alternatives are not viable:

What the writers of these articles don’t understand is that not everyone has a large savings account, 401k, or credit cards with high limits.

Many title loan customers are also already working multiple jobs and do not have other collateral like a home.

This makes getting a personal loan from the bank impossible. To get a cash advance on a credit card you need available credit and a card that allows a cash advance.

We imagine most readers are disappointed with these alternatives, so we’ll provide some useful alternatives in this post.

First, we’ll point out why the title loan alternatives provided by most authors are not useful for most title loan customers.

Get a personal loan from a bank

This title loan alternative is usually listed as the number one or two option in most lists of alternatives. The problem is it is very difficult to get a personal loan from a bank without home equity.

A personal loan from a bank is very difficult, if not impossible, to obtain without perfect credit and home equity.

If you happen to have this option available, by all means take it instead of a title loan.

Payday Alternative Loan

Payday Alternative Loans are great alternatives for Payday Loans, hence the name. Payday loans and Title Loans are very different. There is a reason they’re not called “Title Loan Alternative Loans”.

Most title loan customers either need to borrow more than a Payday Loan will allow or need more time than a Payday loan will provide.

If you only need a few hundred dollars for a few weeks then this may work for you. You can use the Payday Loan Calculator to help find a reasonable Payday loan and compare costs.

Get a part time job

Again, this is usually listed as an alternative to a title loan. While it is easy for someone else to tell you to get a part time job if you need money, the fact is in reality many title loan customers are already working multiple jobs.

For customers working full time or more already, this alternative is not an option.

Often the funds are needed to cover an emergency expense. Finding an additional part time job will not provide the funds quickly enough.

Credit Card Cash Advance

Similar to the personal loan, this is only a viable alternative for those with available credit and a high limit credit card that allows cash advances.

If you have one, then definitely take it as the interest rate will be lower than a title loan. Even a title loan from the best title loan company will be more expensive than a credit card cash advance.

The problem is most people seeking title loans are doing so because they do not have enough available credit to cover their emergency expense.

Real Title Loan Alternatives

Given the lack of real alternatives that title loan customers can act on we will provide three that can be helpful that do not require a bank loan or credit card.

Find a Lower Rate Title Lender

Not all title lenders charge triple digit rates or the 300% APR that most articles note. With the increase in online title loans there are more options for getting a title loan today.

This includes lenders that offer discount title loans that are much cheaper than the maximum rate. For example, a $1,000 loan at 8% per month costs roughly $80 in interest to repay in 30 days.

They are an alternative to the typical title lenders that charge very high rates. If you do decide to get a title loan, make sure to do a cost benefit analysis.

Get A Secured Consumer Loan

Another alternative to a title loan, that you can get quickly, is a consumer loan secured by your vehicle. Companies like OneMain and Lendmark (and others) offer loans secured by your vehicle with interest rates that are less than those of title lenders.

These companies do require OK credit, but may also be able to consolidate other debts. It is worth contacting them to find out if they are a real option for your situation.

Use your Vehicle to Generate Funds

There are several ways you can use your vehicle to generate funds instead of getting a title loan. Whether or not this is a viable option depends on the size of the loan you are looking for and the length of time you have.

The three ways you can use your vehicle to generate cash include:

- Rent – there are services now that allow you to rent your car when you are not using it. They are not available in all areas, but may be worth looking into.

- Delivery – there are a number of companies paying for delivery services, form food and goods to documents. Check demand in your area if you have the time.

- Selling the vehicle – You can also sell your vehicle instead of a title loan. If your vehicle has a significant amount of equity, you can sell your vehicle and purchase a less expensive one.

If you need funds immediately, but want to get more for your vehicle by selling it to a private party, you can get a title loan and place an ad for the vehicle.

Check the difference between trade-in and private party value on kbb.com to determine if it is worth it.

Conclusion

Most people do not plan on getting a car title loan and only do so when absolutely necessary. Prior to getting a title loan it is a good idea to explore all alternatives.

To compare other alternatives with a title loan use our title loan calculator. If you can find a less expensive alternative to a title loan then take it.