Before moving forward with a car title loan it is important to make sure you make a good candidate for one. The truth is not everyone does. They are comparably expensive loans; even discount title loans have higher interest rates than most other loans.

The other important note is that not every, or even most, title lenders will tell you when a title loan may not be the right choice. It is up to you to make that determination.

Determining whether a car title loan is a good choice therefore falls on you as the borrower (unless you find a reputable lender).

So, how do you figure out if a title loan is the right choice? You can start with determining whether or not you make a good candidate for one.

Are Title Loans Bad?

Car title loans are often written about as “bad” and to be avoided. This may be true for some borrowers, as not everyone makes a good candidate for a car title loan.

Some people do make good candidates and for them car title loans serve an important purpose. Online title loans are not necessarily bad or good; the reality is it depends on whether or not you are in a situation where a title loan will provide a significant benefit or solve a major problem.

Online Title Loan Alternatives

The key to making sure you are in the latter category is determining whether or not you make a good car title loan candidate. Not everyone does. Those who are not good car title loan candidates should find an alternative to a title loan.

This is important so it is worth repeating: Car Title loans are not a good choice for everyone. They do serve as an important source of emergency funds for many.

Most car title loans can be manageable and result in a positive experience as long as borrowers make good title loan candidates.

To make a good car title loan candidate, there are some criteria that borrowers should meet. This will help make sure a car title loan improves your financial situation.

Getting a car title loan when you are not a good candidate is likely to cause a financial problem instead of solve one.

Are you a Good Car Title Loan Candidate?

Are you a good title loan candidate? Title loans are short term solutions and not all borrowers make good title loan candidates. FTL Title Loans prefers honesty, transparency, and providing accurate information to title loan customers.

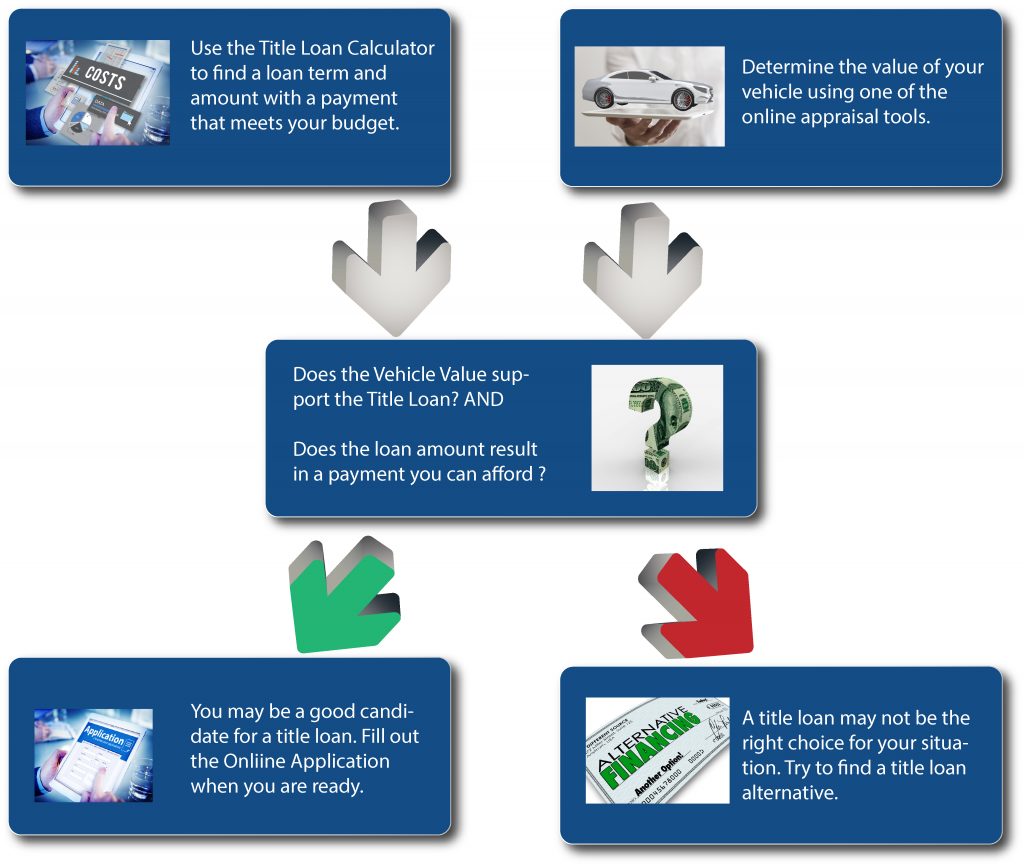

This includes identifying what makes a good title loan candidate, and telling borrowers when a title loan is not the best choice. Follow the simple process below to determine if you are a title loan candidate.

Car Title Loan Candidate Process:

As shown in the figure above, there are several steps to determining whether or not you make a good candidate for a car title loan. Make sure to follow these steps to ensure you make a good candidate prior to proceeding with a car title loan.

Step 1: Finding a Payment

The first step is finding a payment that meets your budget. This has to be a payment you can afford without a problem. Use the car title loan calculator to compare different loan amounts and terms. Find one that results in a payment you can afford.

Step 2: Vehicle Value

Next, find an estimate of the value of your vehicle. The value should be at least twice the loan amount. Most states limit the loan amount to 50% of the fair market value.

Make sure your vehicle has enough equity to support your loan amount. Learn how to accurately asses your vehicle value for a title loan.

Step 3: Deciding if you meet Candidate Criteria

Now that you have your vehicle value and loan amount you can determine whether or not a car title loan can be a solution for your situation. To be a solution, both of the following statement should be true:

- Vehicle value supports the loan amount

- Loan amount results in a payment you can afford.

If both of these are true, a car title loan may be a helpful solution for your situation. If one or both is not, then you should consider finding a car title loan alternative.

Candidate Requirements and Factors

To detemrine whether or not you are a candidate for a car title loan you should go through each of the factors and evaluate yourself against each.

Car Title Loan Candidate Factor 1 – Vehicle

The first factor to be a good candidate for a car title loan is your vehicle. You will need to own the vehicle with no liens. Additionally, the vehicle must have enough equity in it to support the loan amount.

Generally, you can borrow up to 50% of a vehicle’s fair market value. Perform an honest assessment of the vehicle’s condition and look up the value in a guide like Kelley Blue Book.

Some lenders have year and mileage restrictions. This will make getting a title loan, especially a car title loan online, difficult if you have an older vehicle with high mileage.

If the vehicle is a classic car with equity you will likely be able to get a classic car title loan. The vehicle value is the key aspect, you will find the value from Kelley Blue Book.

Car Title Loan Candidate Factor 2 – Short Term Financial Need

Car title loans are meant to solve short term financial problems. To be a good candidate you should have a short term need for funding. If you require a solution with a loan over several years, you should consider an alternative.

However, if you can repay the title loan in less than 24 month (preferably less than 12), you may be a good title loan candidate.

The reason car title loans are short term solutions and not long term is the interest rate. Even a low interest rate title loan can be expensive when compared to other loans.

When the interest rate is increased, and the term is lengthened, the total cost of the loan increases dramatically. See the true costs of title loans for several examples of what happens when you try to make a title loan a long term loan.

Car Title Loan Candidate Factor 3 – Ability to repay the Loan

Another important factor when determining whether or not a title loan makes sense is your ability to repay the loan. A good title loan candidate has the ability to repay the title loan, in full, on or before the due date.

For monthly term loans this means making the monthly payments, at a minimum, on or before the due date each month. If there is any question or doubt about your ability to repay the loan then you should consider an alternative.

Car Title Loan Candidate Factor 4 – The Loan Amount you can Afford solves your Problem

This factor is related to the previous and has to due with the loan amount you are able to afford. It is probably easier to explain with an example. Let’s say you need a $2,000 car title loan to pay for a car repair.

Less than $2,000 will not solve your problem, so you get a quote for a $2,000 loan. You must be able to afford the payment(s) for a $2,000 title loan to be a good candidate.

Final Factor – You Meet the Car Title Loan Requirements

Finally, to be a good candidate, you must meet the car title loan requirements. These may vary from lender to lender, but generally include the following:

- Lien free Title

- Valid Drivers License

- Proof of Insurance

- Proof of Income

- Vehicle Pictures (for Online Title Loans)

If you meet the requirements, and each factor, you may be a good candidate for a car title loan. Remember title loans are meant to be short term loans. Always borrow only what you need and repay the loan as soon as possible to save on interest charges.

Title Loan Candidate Summary

Online title loans are an increasingly available option. Getting a car title loan online is easier today than just a few years ago. This does not mean that a title loan will solve all of your financial problems.

In fact, if used irresponsibly, title loans can cause bigger problems. Carefully consider your options and always make sure you are a good title loan candidate before proceeding.

Next Step – Finding the Right Title Loan

Once you’ve decided you are a good candidate for a title loan then the next step is preparing for and choosing the right loan. This takes some thought and will vary depending on where you live and what types of loans are available to you.

For example title loans are not available in every state. Additionally, completely online title loans that don’t require an inspection, or instant online title loans, are also not available in every state. These loans also have disadvantages that do not apply to in person title loans.